Property tax reform

On this page we would like to inform you about the property tax reform, the new assessment rates and the property tax to be paid from 2025.

The valuation of the developed and undeveloped properties was carried out by the tax authorities of the state of Lower Saxony on the basis of your property tax return. The municipalities were not involved in this process.

The municipalities are only obliged to publish the revenue-neutral assessment rate for property tax B, i.e. the assessment rate at which the tax revenue in 2025 would be the same as in the previous year. The municipalities in the Neuenhaus joint municipality have all already adopted the new assessment rates. These are as follows:

| Property tax A | Property tax B | |

| City of Neuenhaus | 360 v. H. | 334 v. H. |

| Municipality of Esche | 357 v. H. | 284 v. H. |

| Municipality of Georgsdorf | 345 v. H. | 221 v. H. |

| Community Lage | 335 v. H. | 271 v. H. |

| Municipality of Osterwald | 345 v. H. | 224 v. H. |

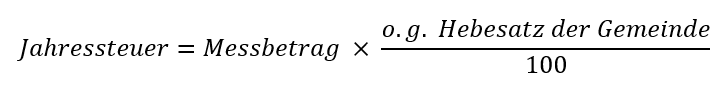

To calculate the annual tax, you can multiply your measured amount by the assessment rate:

The tax office has informed you of your taxable amount in a notice. If you have any questions about the calculation of the taxable amount, please contact your tax office. You can find the contact details in the notice.

If your measured amount is incorrect, you can apply to the tax office for a correction in the following ways:

- via Elster with "other message" or "property tax change notification"

- via contact form for tax questions

- Complete the correction form and send it to your tax office by e-mail or post. You can obtain the form here. The e-mail address is poststelle@fa-ben.niedersachsen.de

Here you will find answers to the most frequently asked questions: FAQ